The most typical secured loans are mortgages and vehicle loans. In these examples, the lender holds the deed or title, which happens to be a representation of ownership, right until the secured loan is completely compensated. Defaulting with a home finance loan normally ends in the bank foreclosing on a home, whilst not spending an auto loan ensures that the lender can repossess the vehicle.

Dealership financing is somewhat identical apart from the auto loan, and so paperwork, is initiated and finished in the dealership as an alternative. Auto loans via dealers usually are serviced by captive lenders that tend to be connected with Every single motor vehicle make. The deal is retained by the vendor but is frequently marketed to some financial institution, or other fiscal institution known as an assignee that in the long run solutions the loan.

A lot of client loans slide into this class of loans which have frequent payments which are amortized uniformly about their lifetime. Plan payments are made on principal and interest right up until the loan reaches maturity (is completely paid out off). Many of the most common amortized loans incorporate home loans, car loans, student loans, and private loans.

Some loans, for instance balloon loans, can even have scaled-down schedule payments for the duration of their lifetimes, but this calculation only is effective for loans with an individual payment of all principal and fascination owing at maturity.

Having said that, as SBA proposed to just accept purposes For brand spanking new SBLCs every now and then in portion a hundred and twenty.ten, there may be intervals when new SBLC Licenses are usually not remaining issued and existing Licenses are going to be obtained and transferred. Thus, SBA proposed to revise this section to state that an applicant to be an SBLC ought to exhibit a letter arrangement from an current SBLC whether it more info is getting an present License. For the reasons mentioned higher than, SBA is going ahead as proposed.

This arrives out to be an $800 variance which may be a reason for people today marketing a car in these states to think about A non-public sale.

SBA carried out a comprehensive Value profit Evaluation from the proposed rule. SBA does not foresee any from the adjustments built During this closing rule will considerably modify any in the assumptions essential for the Examination; as a result, the cost reward Assessment remains unchanged which is synopsized below.

Identical to with another amortization, payment schedules is usually forecasted by a calculated amortization agenda. The next are intangible belongings that will often be amortized:

Underneath the proposed rule, SBA will point out loan approval by issuing a loan selection. For that reason, SBA proposed to remove the reference on the Loan Authorization And so the sentence will point out “If authorized, SBA will notify the ALP CDC from the loan number assigned into the loan.”

Despite the fact that most automobile purchases are created with automobile loans within the U.S., you will find benefits to purchasing an automobile outright with cash.

You are able to mess around with our Loan Payoff Calculator over, or give our loan calculator a consider, to discover how overpayments can shorten the size of the loan and reduce the

Using the values from the example above, if The brand new automobile was bought in a point out with out a revenue tax reduction for trade-ins, the sales tax can be:

Document webpage sights are up to date periodically each day and so are cumulative counts for this doc. Counts are subject matter to sampling, reprocessing and revision (up or down) throughout the day. Site views

An amortization timetable assists suggest the specific volume that can be paid out towards Each individual, along with the curiosity and principal paid out to this point, as well as remaining principal balance immediately after Every pay back interval.

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Danica McKellar Then & Now!

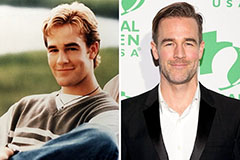

Danica McKellar Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now!